"Art as a Dynamic Investment: The Trend of Resale"

The Trend of Resale

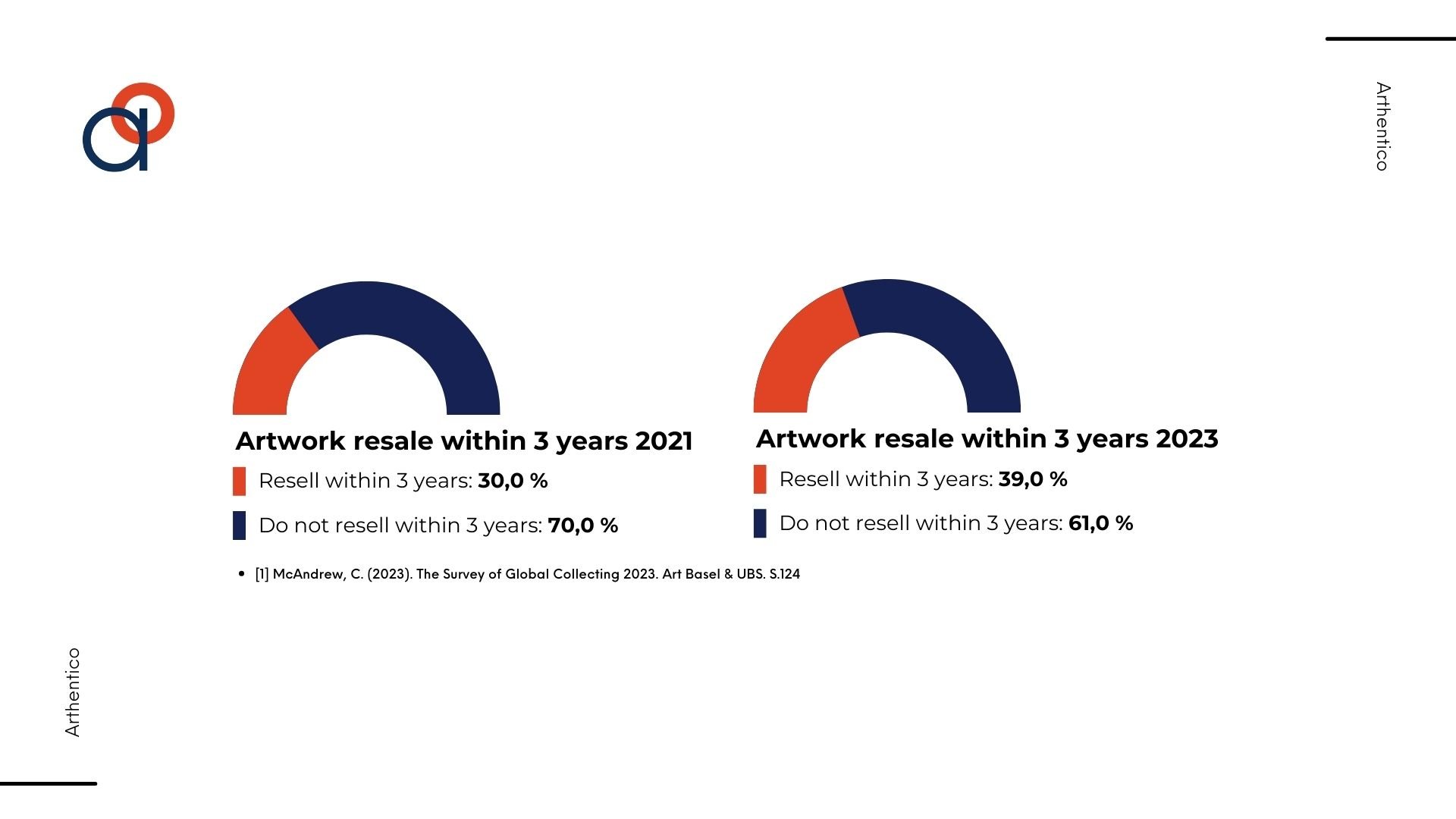

In the realm of art investments, a fascinating pattern emerges. While only a small fraction of collectors (5%) resell their artworks within a year, a significant majority show remarkable commitment to medium-term investments. Our latest research, based on a survey conducted by Art Basel, reveals that 39% of art collectors typically resell artworks within a span of up to three years. This figure marks a significant rise from 30% in 2021. Furthermore, it's striking to note that a vast majority of collectors, about 83%, tend to resell their artworks within a five-year period, showing an increase from the 73% reported in the previous year.*

These data are not only a reflection of global markets but also demonstrate a consistent tendency across different generations of collectors. They reveal an important insight: Most collectors view art not just as a long-term emotional investment but also as a dynamic asset class, in which they actively trade within a relatively short timeframe.

What does this mean for you as a collector?

This trend underscores the flexibility and potential of art as an investment. It shows that artworks are valued not only for their aesthetic and emotional worth but also as wise, medium-term financial decisions. When you acquire art, you invest in an asset that not only has the potential to enrich your environment but also to generate financial returns within a manageable timeframe.

At Arthentico, we offer you not only access to exquisite artworks but also the opportunity to re-sell your paintings at an 6x lower commission fee than market standards. Become part of a global community of forward-thinking art collectors & discover art as an investment that enriches both your spaces and your portfolio.

*[1] McAndrew, C. (2023). The Survey of Global Collecting 2023. Art Basel & UBS. S.124